The RIB (relevé d’identité bancaire) is a document showing all your bank details: account number, IBAN, BIC, etc. The RIB serves as your bank account’s identity card and is used in France to make a transfer, pay a bill or set up a direct debit.

In this guide, we’ll explain everything you need to know about the Relevé d’Identité Bancaire: what it is, what it contains, what it’s used for and where to find your French RIB. There will no longer be any secrets when it comes to carrying out banking transactions or receiving transfers in France or abroad.

What is the RIB ?

The RIB, or Relevé d’Identité Bancaire, is a document that identifies a bank account and gives all the details of its holder. Provided by the bank, it contains a wide range of French and international information: identity of the account holder, bank information, account number, RIB key, IBAN, BIC, etc.

What is the difference between an RIB and an account number?

The account number, a series of 11 digits or letters, is part of the RIB. It is preceded by the branch code (identifying the branch that manages your bank accounts) and followed by the RIB key (verifying the validity of your account number).

What is the difference between an RIB and an IBAN?

The RIB and the IBAN (which is always indicated on the RIB) both provide identical banking information (bank code, account number, RIB key) and can be used to make transfers or direct debits. However, the RIB can only be used in France, whereas the IBAN can be used both in France and abroad. The RIB also provides more information, such as the BIC code.

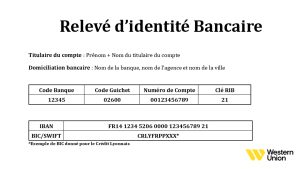

What does an RIB look like?

A bank’s RIB is a paper or electronic document that most often takes the form of a text box containing all the bank details of an account holder. While the format of the relevé d’identité bancaire may vary depending on the bank, its presentation remains mostly similar, with the same information shown.

Note that the paper version of an RIB usually appears twice on an A4 sheet, so you can cut out one copy of the bank RIB to keep with you (in your wallet, for example) and the other at home if you need it.

What does the RIB contain?

A RIB contains a wide range of banking information:

- The full name of the account holder;

- The bank’s information (name of bank);

- The bank code;

- The branch code;

- The account number;

- The RIB key;

- The IBAN (International Bank Account Number);

- The BIC/SWIFT code (Business Identifier Code).

If the account holder is a legal entity—a company, association, etc.—the bank RIB also indicates its corporate name. In addition to the mandatory information, the bank’s RIB may, depending on the bank, indicate the address of the account holder and the address and telephone number of the bank branch managing the account.

Example of an RIB

To help you learn everything you need to know about the relevé d’identité bancaire, here is an example of an RIB showing all the information you need to know.

What is the RIB for?

The RIB, which accurately identifies your bank account, makes it easy to carry out credit and debit transactions without risk. It has two main uses:

- To receive money via transfers (such as SEPA transfers),

- To send money to third parties and make regular or direct debit payments using a mandate.

With the relevé d’identité bancaire, in particular with your IBAN, you can make transfers to third parties or receive money (such as your salary, government aid, medical reimbursements or any other transfer). You can also set up regular or automatic direct debits with a bank RIB, to pay your rent or mortgage or to pay your bills, taxes, etc.

Before carrying out any banking transactions with your bank’s RIB, remember to check it over to ensure that the information is correct.

Where do I find my RIB?

It’s very easy to find your RIB, which is available:

- On your account statement;

- In your banking customer area, whether on the website or via the mobile app;

- At your bank’s physical counter or automatic machines;

- On some ATMs, which may display your RIB;

- On your checkbook.

How do I get an RIB?

There are several ways to get an RIB:

- An RIB will automatically be sent to you when you open a bank account;

- In your customer area, by downloading it onto your computer or telephone;

- At the branch where you opened your bank account;

- When you order a checkbook, it contains several relevés d’identité bancaire.

Once you have obtained your bank RIB, you can print it out and keep it with you, or download it and keep it on your smartphone, for a quick reminder of your bank details if you need them.

FAQs

Can I change my RIB?

No, it is not possible to change the bank details on your RIB, which are linked to your account. However, it is possible to change the personal information displayed on your statement if you change your first or last name. You must then update this information in your customer area.

To change the bank RIB used for your banking transactions, you need to open a new account with a different bank (or with the same bank by closing your existing account). You will then need to inform your creditors and debtors (such as your employer, tax authorities, family allowance fund, social security, etc.) of your new bank details.

Are there any risks in giving out my RIB?

There is normally no risk in giving out your RIB. It is not a means of payment and you must sign an authorization mandate for a direct debit to be possible. However, it is essential to always identify the individual or legal entity to which you are giving your bank RIB, in order to avoid the risk of fraud.

In the event of theft or an unauthorized direct debit using your French RIB, you can contact your bank to dispute the transaction. You generally have one year in which to dispute a bank transaction and get your money back.

Can I give my RIB to a stranger?

Yes, because there is little risk in giving your RIB to a stranger. Although they can credit your account, they cannot make any direct debits without your agreement. However, there is a risk of fraud or identity theft and you need to be very careful about those with whom you share your relevé d’identité bancaire.

If I give the wrong RIB, can I get my money back?

The bank is not obliged to refund you in the event of an incorrect bank RIB (such as an incorrect IBAN or BIC). However, in general, banks will try to refund funds in the event of an error.