Did you know that through Western Union you can send money to over 150 banks in India? Sending directly to a bank account in person from a Western Union agent location in Singapore is one of the best ways for your loved ones to receive their money in India. Send money directly to India’s top banks such as ICICI Bank, State Bank of India, Axis Bank, Yes Bank IndusInd Bank and other leading banks

We’re here to provide you with the information needed to easily deposit money directly to a bank account in India.

Send and receive funds directly to bank accounts in India in a few simple steps:

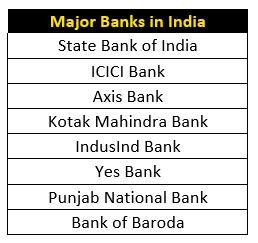

Check out the list of some of the top banks to which we can process direct transfers!

Before you head to a nearby agent location, be prepared with your receiver’s banking information.

Receiver information needed to transfer money to a bank account:

- Name (First / Last) – exactly the way it appears on your receiver’s state issued ID.

- Address, city, state

- Bank name (Drop Down)

- Account Number

- Account numbers in India can be 9 to 18 digits long. Double-check with your receiver to make sure you have the correct one.

- IFSC Code

- Indian Financial System Code (IFSC) is an 11-digit code written in an alphanumeric format.

- Purpose of Transaction

Note: It is very important that the details being provided including Bank name are accurate to avoid delays.

There’s more! Now Money can be simply sent to your receivers UPI ID in minutes.

No need to provide receivers account number or IFSC code. All you need is their UPI ID which looks like an email ID. Some popular examples of UPI ID’s:

- receiver-name@bankname

- mobile-number@bankname

- mobile-number@UPI

- G-Pay- email ID@okaxis (or any other corresponding bank. They us “ok” as suffix in most cases)

- BHIM App- mobile-number@UPI or name@ybl (for yes bank)

- Paytm- mobile-number@paytm

- PhonePe- mobile-number@ybl or receiver-name@ybl

- SBI Bank- receiver-name@SBI or mobilenumber@SBI

- ICICI Bank- receiver-name@icici or mobile-number@icici

How can your receiver register for a UPI ID? Please see the example below for G-Pay (UPI activation process may vary depending upon the bank or digital wallet)

- Open Google Pay

- In the top right, tap your photo.

- Tap Payment methods

- Tap the bank account for whom you want to create a new UPI ID

- Select “Manage UPI IDs”

- Tap the ‘+’ next to the UPI ID you want to create

- When making a payment, you can select the UPI ID you want under “Choose account to pay with”

Plan ahead to make sure your money gets deposited at the time you want it to be deposited.

How fast will the money get deposited into my receiver’s bank account?

When sending money to a bank account in India, the deposit can take anywhere from a few minutes to as fast as one business day. For example, State Bank of India, ICICI Bank Limited, Axis Bank, Punjab National Bank, and Bank of Baroda have the capability to credit deposits in real time2 or in minutes. Banks such as Yes Bank may take up to one business day.

Keep in mind that other local banks may have deposit cut-off times during the week or could be closed over the weekends and holidays. These are factors that may delay funds being deposited into your receiver’s bank account.

In what currency will the money be deposited?

Indian Rupee.