If you’ve ever needed to send money securely or make a payment but didn’t want to use cash or checks, a money order might be the perfect solution. Whether you’re paying bills, sending money to family or making a purchase, money orders offer a safe and reliable way to transfer funds. In this guide, we’ll break down what a money order is, how to use one, and why it might be the right choice for you. Let’s dive in!

What is a money order?

A money order is a secure, prepaid way to send money, make payments or even pay bills. Think of it as a reliable alternative to cash or checks, especially when you need something safe and guaranteed.

You can buy a money order from any participating Western Union® agent location. If you’re wondering where the nearest one is, find a location near you!

Why use a money order?

There are a few great reasons why people love using money orders. Here’s why they might be the right choice for you:

Guaranteed funds

Unlike checks, which can bounce if there’s not enough money in the bank, money orders are prepaid. That means the funds are already set aside, ensuring they’re available when the receiver cashes it.

Security

Money orders are safer than personal checks since they don’t include sensitive bank account details. It makes them less risky for identity theft and fraud.

Widely accepted

Money orders are accepted by many businesses and individuals, especially those who don’t take checks or credit cards. So, you’re good to go almost anywhere!

No bank account needed

You don’t need a bank account to buy a money order. You can pay with cash, which makes them a great option if you don’t have a checking or savings account.

Payment tracking

When you buy a money order, you get a receipt with tracking info. This lets you check the status of the money order to see if it’s been cashed, giving you peace of mind.

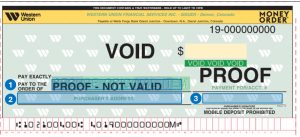

How to fill out a money order (step-by-step)

If you’ve never filled out a money order before, don’t worry. Here’s a simple, step-by-step guide to help you fill out your money order correctly:

1. Write the name of the recipient

In the “PAY TO THE ORDER OF” section, write the name of the person or company you’re sending the money to. Double-check the spelling to avoid delays—once it’s filled out, it can’t be changed!

If the recipient’s name is correct, they’ll be able to cash the money order right away. If not, it could cause delays, especially if you’re paying for something important like a bill or rent.

All Western Union money orders include a “PAYMENT FOR/ACCT. #” field. You can use this space to add a note – such as “Rent apt #123” or “Invoice #1234.” This is optional, but it can be helpful for recordkeeping. If you don’t need to include anything, feel free to leave it blank.

2. Fill in your details (the purchaser)

The purchaser is you, the person buying the money order. You’ll need to enter your full name and address in the From or Purchaser section. Make sure it’s your full legal name and current mailing address.

3. Sign the front of the money order

Sign your name on the front of the money order, not the back. The back is reserved for the recipient when they go to cash it.

Once you’ve checked everything, you’re ready to send the money order! If you’re mailing it, we recommend getting tracking information, so you can make sure it doesn’t get lost along the way.

4. Keep the receipt

Your money order will come with a detachable receipt. Hold on to it! This is your proof of purchase and also contains tracking info to help you confirm when the receiver has cashed it.

Remember, money orders can’t be purchased online, you’ll need to visit an agent location. But don’t worry, it’s super easy to find one. Just use the Western Union location finder to find an agent near you, and we’ll be happy to help you complete your transaction!

Other ways to send money with Western Union

If you need other options to send money, we’ve got you covered. Western Union offers plenty of ways to transfer money that fits your needs – whether it’s online, via our mobile app or in person. You can get more information on how to send money on our website or contact us if you need help along the way. For more information on using Western Union, please see our frequently asked questions.

Ready to send money? Download the Western Union app or visit a nearby agent location today!