Send money to Haiti

{senderCurrencyName} to {receiverCurrencyName}

Register now to get better exchange rates and $0 fees on your first transfer*.

*FX gains apply. Not available for credit cards.

Convert {senderCurrencyCode} to {receiverCurrencyCode} with Western Union to send money internationally.

Check Rates

Fee: from {{strikedFee}} to {{fee}}

FX: 1.00 USD = from to

We encrypt your transfers.

We are committed to keeping your data secure.

Send, spend, and receive money transfers with the Western Union Prepaid Visa® Card

Our fee waiver continues! $0 card purchase, $0 reload, and $0 per transaction fees now through April 30th, 2026.

*Other fees apply, see Cardholder Agreement for details.

Convenient ways to send and receive money

Ways to send money to Haiti

Ways to receive money in Haiti

Send online

Transfer money to Haiti at the click of a button by logging in or registering for free.

Explore your optionsBank Account

Send money to bank accounts directly, including Sogebank, Unibank and Banque Populaire Haitienne.

Learn moreCash pick-up

From Port-au-Prince to Cap-Haitien, we have more than 1,2002 agent locations across Haiti to make it easy for your friends and family to collect their funds.

Find locationsMobile Wallet

With mobile wallets, sending money is easier and faster than ever before. Choose from MonCash, Natcash or LajanCash mobile wallets.

Start a transfer

Send money to our network in Haiti

For 150 years, Western Union has been a leading global provider of fast and easy money transfers. Use our extensive network of payment service providers in Haiti for seamless transactions. Whether to wallets, bank accounts, or for cash pickup, enjoy reliable payouts.

Our featured payout partners in Haiti include Digicel, Sogebank, Unibank, Unitransfer, and Capital Bank.

We also partner with many other trusted institutions, such as Haitipay Lajancash, Banque de I Union Haitienne, and Sogebel. You can also find multiple cash pickup locations here.

Choose the way you pay

Using your banking details

With the Western Union Prepaid Visa® Card

Cash at an agent location

With a credit3 or debit card

Refer a friend!

Get rewarded up to $300 in Amazon.com e-gift codes* when referring friends.

Terms and conditions apply.

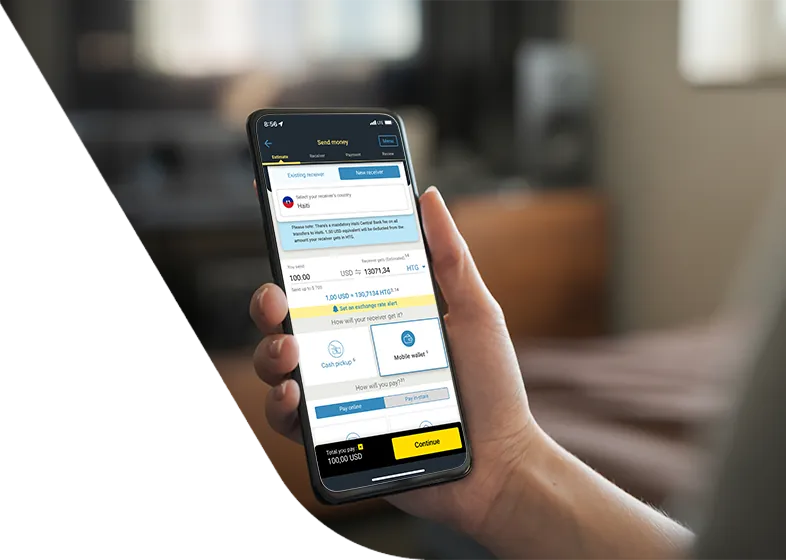

Send money to Haiti in a few taps with our app

Send money for cash pick-up in minutes or directly to a bank account or mobile wallet

Track your money transfer as soon as you press send

Save details and send again to friends and family

More information on how to send money to Haiti from the US

Calculate your costs

With Western Union it’s easy to calculate the costs involved in sending money to Haiti from the US. Use our online price estimator to get a breakdown of the exchange rates and transfer fees4 involved.

Prepare your paperwork

Create a smoother money transfer process by making sure you have everything you need ready to go. This includes a form of government-issued ID and the receiver’s details.

Choice of currencies

Send money to a Haiti bank account when you select US dollars as the receive currency. Cash pickup is available when selecting Haitian gourde as the receive currency.

Reasons to choose Western Union®

Register for free

Registering for a Western Union profile is free and there are no hidden charges. You can send money to Haiti straight away after completing a few easy steps.

Encrypted money transfers

Every money transfer we make is covered by encryption and we’re committed to fraud prevention.

The choice is yours

You can choose to send funds while on the go through the app, online via our website or in person at our agent locations.

A rich heritage

Our technologies are powered with encryption, among other fraud prevention measures, for peace of mind as your money moves from the US to Haiti.

Sign up to send money to Haiti today

Track your money transfer

Follow your funds all the way from the US to Haiti thanks to your unique tracking number (MTCN) and our online tracking tool.

Send again quickly

Save your loved ones’ details when you register to make sending money home even easier next time.

Never miss a payment

Set up regular money transfers or make sure your gift always arrives on time by scheduling in advance.

Frequently asked questions about sending money to Haiti from the U.S.

How much money can I send to Haiti online?

You can send up to $5,000 from the US to Haiti for cash pickup or when transferring money to a bank account. You can send up to $700 to a mobile wallet in Haiti.

How do I send money to Haiti online?

You can send money to Haiti online by following these easy steps:

- Register or log in to your profile and click the ‘Send money’ button to start your money transfer.

- Enter the amount of money you’d like to send and choose Haiti as the destination.

- Choose your currency (US dollars for Haitian gourde) and the corresponding receive method (US dollars for bank account or Haitian gourde for cash pickup and mobile wallets.

- Select credit3 card, debit card or bank account as your payment method.

- Enter your loved one’s information.

- Confirm your payment details.

- Wait for the confirmation email to arrive. This will contain your unique tracking number (MTCN) – keep hold of this so you can follow your funds to their destination.

What do I need to send money online to Haiti?

When sending money to Haiti online, you’ll need to register for a free Western Union profile.

To create a profile with us, you’ll need:

- Your full name and address

- An email address and password

- A US driver’s license, passport, or other form of government-issued ID

How do I send money to Haiti from a Western Union agent location?

First, use our location finder to choose an agent location nearby.

- Visit the agent location with your photo ID, personal banking details (if applicable) and receiver’s details.

- You can choose to pay for your money transfer in cash or with a US debit or credit3 If you’ve already started a money transfer online via the Western Union® app, you can finalize the payment in person.

- Keep your unique tracking number (MTCN) safe and share it with your receiver so that they can collect their funds when they arrive.

How do I estimate the cost to transfer money to Haiti?

You can find out how much your money transfer might cost, as well as checking the exchange rates, before you send money to Haiti with our price estimator tool.

What do I need to send to a mobile wallet in Haiti?

When sending money to a mobile wallet in Haiti (MonCash, Natcash or LajanCash), you will need the receiver’s name and wallet mobile number.

Still have questions?

Visit our FAQs or simply get in touch. Our Customer Care team is just a call away.

1 Funds may be delayed or services unavailable based on certain transaction conditions, including amount sent, destination country, currency availability, regulatory issues, identification requirements, agent location hours, differences in time zones, or selection of delayed options. For mobile transactions funds will be paid to the receiver’s mWallet account provider for credit to the account tied to the receiver’s mobile number. Additional third-party charges may apply, including SMS and account over-limit and cash-out fees. See the transfer form for restrictions.

3 If you’re using a credit card, a card-issuer cash advance fee and associated interest charges may apply. To avoid these fees or for reduced fees, use a debit card or check other payment methods.

4 Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice.